The COVID-19 pandemic has made stark the issues with our economy, highlighting the urgent need for reform. It is critical that reforms are robustly evaluated policies rather than hastily-lobbed subsidies that reflect the desires of the interest groups who have the major parties in their pockets.

Australia’s tax system was designed for an industrially-advanced economy, but not a technologically-advanced economy. The last time our tax system underwent structural reform was in the 1980s.

We need a tax system that is fit-for-purpose for the modern economy.

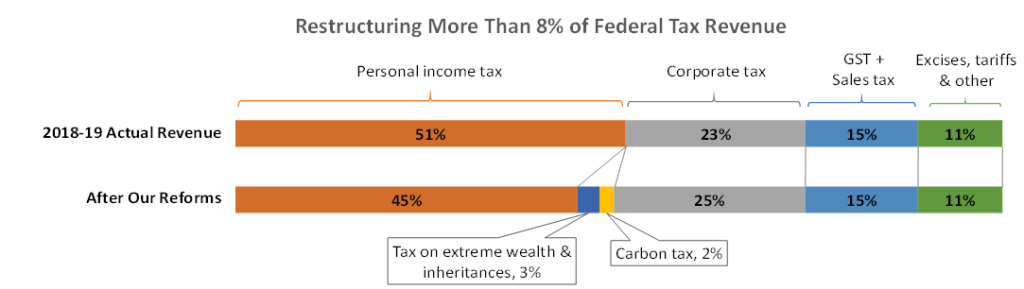

We are proposing 10 core tax reforms that will transform Australia’s tax system, restructuring more than 8% of total federal tax revenue.

Note: Based on total 2018-19 Commonwealth Government revenue of $456 billion. This illustration excludes revenue collected by state & local governments (such as payroll taxes, land taxes & stamp duties). State and local governments collected an additional $105 billion in revenues in 2018-19.

We propose the re-introduction of a carbon tax, which, in conjunction with our energy & infrastructure strategy, will create the incentive structures to drive the green transition. The revenue raised by the carbon tax will fund investment in the grid of the future and electrification across our economy.

Transformative tax cuts for low and middle income earners will mean a 11% increase in after-tax income for an individual earning $37,000 a year.

The data is very clear in showing that cutting tax for those with lower incomes will have the largest economic benefit, because this group spends the largest portion of every dollar they earn in income. National Accounts data from 2017-18 shows that the 20% of households with the lowest incomes spend $1.37 for every $1 they earn. The equivalent figure for the top 20% of households is just 70 cents for every $1 they earn. This means that our proposed tax cuts will flow back into the economy, creating a multiplier effect.

Our proposed income tax cuts will be funded by introducing moderate taxes on extreme wealth (above $100 million) and inheritances (above $10 million). Together our reforms will provide a net benefit to all but the wealthiest 2% of Australians.

We do not support the government’s stage 3 tax cuts which are a giveaway to higher income earners.

Recent empirical evidence shows that tax cuts for higher income earners do nothing to boost the economy. By the same token, levying higher taxes on the very wealth will do little to deter growth. The next generation of innovators and entrepreneurs like Atlassian founders Scott Farquhar and Mike Cannon-Brookes (whose self-confessed goals were “to make $35,000 a year and not have to wear a suit”) aren’t likely to be concerned by the tax rate they pay on every dollar they earn after the first hundred million.

In addition to our tax reforms for individuals, we will address corporate profit-shifting by multinational firms which has become rife in the last 20 years. It is simple; business that is undertaken in Australia should be taxed in Australia. It is a lie that Australia has a globally uncompetitive corporate tax rate. Analysis by Kevin Davis and Miranda Stewart from the University of Melbourne shows that when our imputation system is taken into account, the real corporate tax rate in Australia is between 15% and 20%, low relative to other developed nations.

Our reform plan will release the purchasing power in the economy, by shifting the tax burden away from lower and middle income earners and it will drive the green transition, by investing in clean energy and putting a price on carbon.

A summary of our 10 proposed reforms is below. More detailed information and analysis can be provided on request.

We should be properly enforcing corporate taxation and not be cutting it.

We are proposing 10 core tax reforms:

| Simplify the tax system | The 2009 Henry Review found that Australia had 125 different taxes and suggested rationalizing taxes that contribute minor amounts of revenue. |

| Phase out stamp duties | Transaction stamp duties to be phased out and replaced with broad-based land taxes over a transitionary period. – This reform will be revenue-neutral and will allow people to move more freely as they won’t face large transaction costs on buying and selling properties. – To avoid taxing agricultural land, land below a certain value per square metre should be exempt, as should the principal place of residence. |

| Carbon tax | Implement a carbon tax of $30/tonne with the intention of increasing the price in line with Australia’s key trade partners A price on carbon forms a key part of our plan to drive the clean energy transition |

| Abolish the lowest personal income tax bracket | Increase the tax-free threshold for personal income tax to $37,000 (from the current $18,200) by abolishing the lowest tax bracket. – This will increase take-home pay by 11% for someone earning $37,000 |

| End corporate tax avoidance | As a principle, design policy so that economic activity that takes place in Australia is taxed in Australia and not shifted to tax havens Specifically: – For multinational corporations, tax liability is to be assessed against the portion of global profits that come from Australian sales (identical to the system used by individual US states to allocate state-level corporate tax.) – Increase funding to the ATO to properly enforce corporate taxation and combat profit shifting by multinational corporations |

| Tax on extreme wealth | Introduce a tax on the hyper-wealthy, calculated as the greater of a and b below, based on the following tiers: a. A tax on extreme wealth, based on the following tiers: – 1% p.a. tax on wealth between $100 million and $500 million – 2% p.a. tax on wealth between $500 million and $1 billion – 4% p.a. tax on wealth over $1 billion b. 10% tax on annual earnings greater than $3 million |

| Inheritance tax on amounts over $10m | Introduce an Inheritance Tax of 15% on all endowed amounts above $10 million. Applied to all assets irrespective (no discounting or concessions). |

| Capital gains discount | Reduce from 50% to 25% |

| Negative Gearing | Change negative gearing rules to only apply to investment in new housing For details see our platform on Addressing Housing Affordability |

| Tax super profits on non-renewable resource extraction | As recommended by the 2009 Henry Review of Taxation |

We needn’t pick a side between labour and capital, but instead observe the secular changes at play in the economy and structure our tax system in a way that maximises well-being for Australians.

There is a middle way, that harnesses the efficiencies of capitalism while providing equal access to quality healthcare and education, a social welfare net, and that incorporates concern for the impacts of economic activities on the natural environment.

Keep Reading: Our Approach to Economic Stimulus, Energy and Infrastructure