We propose to implement a carbon tax of $30/tonne, with the price to increase in line with carbon prices adopted by Australia’s key trade partners.

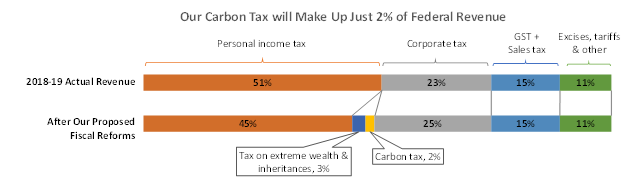

This would raise over $10 billion per year, funding income tax cuts that will assist those affected by short-term price impacts and fund investment in transforming the electricity grid.

Note: Based on total 2018-19 federal government revenue of $456 billion.

For more details on how we plan to reform the tax system, see our economic platform.

The world has changed, global carbon pricing is here

Recent progress shows there is growing momentum for carbon pricing at a global level, following announced commitments by major economies. This concept of countries agreeing to iterative and progressively more ambitious commitments toward climate goals has been explained by Nobel Prize-winning economist William Nordhaus in what he calls ‘Climate Clubs’.

Critics of carbon pricing, such as Tony Abbott, argued that it would make Australia less competitive. Notwithstanding the extreme short-sightedness of this thinking, the geopolitical situation with respect to climate change has changed since 2014. The EU is developing policy to implement a carbon border adjustment mechanism, which will mean Australia will be penalised for not having a carbon price. Note the current EU carbon price is around US$40/tonne.

Energy policy certainty will stimulate investment

The economic analysis is very clear. A price on carbon is the most efficient way to ‘internalise’ the cost of carbon. It is technology-agnostic, meaning it does not require government to make bets on what are the best low-emissions technologies. It will create a price signal that will allow the market to decide the least cost pathway to decarbonation across all sectors of the economy.

A carbon tax and an emissions-trading scheme (ETS) are both ways of implementing a price on carbon. A carbon tax sets a price and then lets the market determine the quantity of carbon emissions, while an ETS sets the quantity (cap) and then lets the market determine the price (trade). A carbon tax is preferred by business because it provides industry firms with a fixed price, allowing businesses to make informed budgeting and investment decisions.

Price certainty under a carbon tax is especially critical for investment in electricity assets like energy generation/storage and transmission lines. The lack of a coherent energy policy under successive Liberal/National governments has driven underinvestment in energy generation assets, driving up energy prices. A carbon price will be the backbone of a consistent and long-term energy policy for Australia and support the positive contributions made by individual Australian states and industries.