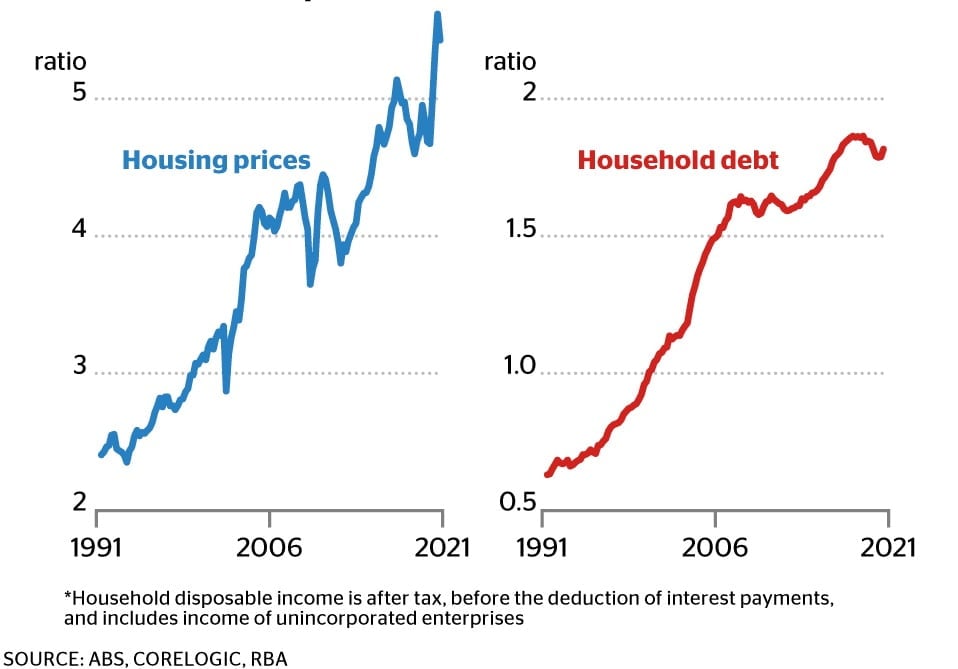

House prices and debt relative to real wages continues to soar driven by investor tax breaks and low interest rates.

This problem won’t go away until Federal tax and housing policy changes – or interest rates climb dramatically.

Unfortunately the government continues to prioritise wealthy investors over young home-buyers, effectively shutting disadvantaged people out of the housing market.

References

- Our housing platform

- One graph that shows why it’s harder for Millennials to buy a house (Elizabeth Redman, The Age, Dec 2021)

- To fix Australia’s housing affordability crisis, negative gearing must go (The Conversation, April 2021)

- Melbourne houses climb $457 a day amid fears of living standard hit – “Ponzi Scheme” (The Age, September 2021)