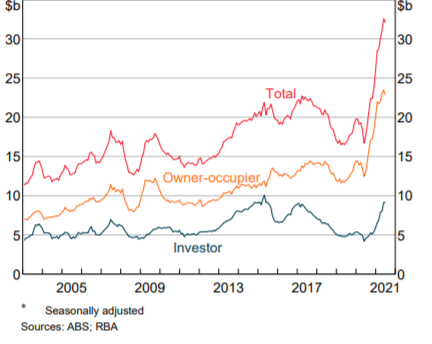

With interest rates close to zero and no end to investor tax breaks in sight, Australia has recorded record inflows of capital into the housing market. House prices are likely to continue to increase by 20 per cent year-on-year for the foreseeable future.

Removing housing tax breaks alone is unlikely to slow house prices while interest rates are so low. When interest rates do rise many recent home buyers are likely to find themselves in significant financial stress.

Macro-prudential controls such as loan caps based on the recent taxable income of the buyers offers a pathway back to affordable housing prices.

With all bidders limited to borrowing a fixed percentage of their recent taxable income to buy a home, house prices should be able to be managed down to affordable levels. Different borrowing limits on investors, movers and first home buyers would bias outcomes in favour of first home buyers.

We also propose reforming negative gearing and capital gains tax exemptions, along with building thousands of new homes for both public housing and sale to first home buyers.

See also our Housing Platform.

References

- Melbourne houses climb $457 a day amid fears of living standard hit – “Ponzi Scheme” (The Age, September 2021)

- Lending restrictions need to be considered (SMH, September 2021)

- APRA’s moves to cool housing could end banks’ golden run (AFR, April 2021)

- To fix Australia’s housing affordability crisis, negative gearing must go (The Conversation, April 2021)

- Value of macro-prudential reforms such as loan caps (ABC, September 2021)

- Soaring housing debt a financial risk: Reserve Bank (The Age, September 2021)

- CBA boss ‘increasingly concerned’ with rising property prices (The Age, September 2021)