In a year where those in the richest 20% saw their assets inflate substantially, while wages remained flat or down, it’s amazing to see how hard those at the top are clamoring for their Stage 3 tax cuts.

The maths is simple, the stage 3 tax cuts are cuts to the top tax brackets, so they benefit the top 20 or so per cent of income earners.

Nevermind that new research from the London School of Economics looking at historical tax cuts for the rich in 18 developed countries over the last 50 years found that they had no significant effect in increasing economic performance (as measured by real GDP per capita and the unemployment rate). The Stage 3 tax cuts have no justification on the basis of efficiency.

But tax policy is about efficiency and fairness. So what is fair?

Arguing for why the Stage 3 tax cuts are ‘fair’, Economist and Australian Financial Review contributor Chris Richardson points out that “the top 5 per cent of taxpayers pay a third of all personal tax.”

And he is right,

The top percent of income earners do pay a larger share of the tax, because they also earn a heck of a lot more. This is what is known as a progressive tax system.

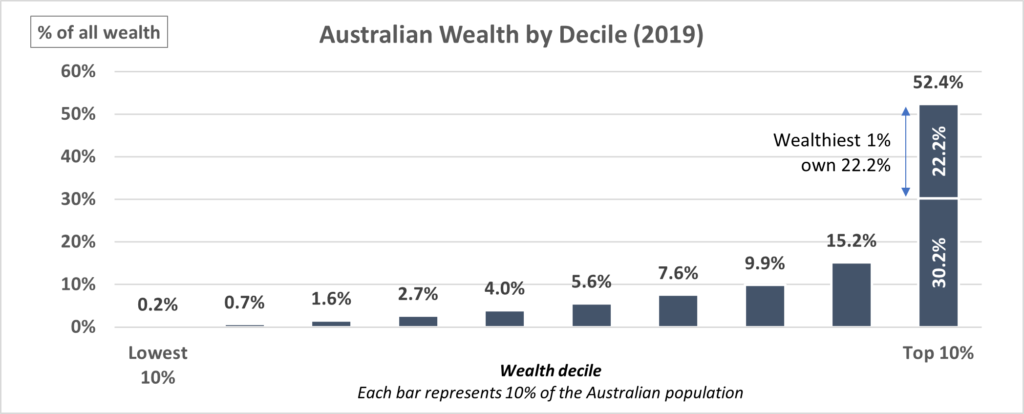

In thinking about how the tax burden might be fairly distributed it would make sense to consider the wealth of those at the top.

The richest 20% of Australians own 52.4% of all wealth.

When it comes to net shares (i.e., the sharemarket), the top 20% own 69% of all assets.

It’s worth keeping that in mind when considering what is fair.