The need for continuous baseload power has been a recurring theme for years, with coal and gas seen as firming options. Nuclear power has also been considered as a non-carbon emitting alternative and given that Australia does not have a commercial nuclear industry, the concept of ‘off the shelf’ nuclear small modular reactors (SMRs) has been raised, particularly by the Coalition. But is this a reasonable response to Australia’s need to transition rapidly to a low carbon future?

There are a number of layers to this question. Apart from increasing needs for non-polluting power, Peter Dutton recently suggested that Australia should not be dependent on China as a major source of solar and wind technology but should instead overturn its legislative ban on nuclear power, and supplement that technology by introducing nuclear SMRs or Micro Modular Reactors (MMRs) from the US, UK, France “and other trusted partners”. By calling SMRs a ‘companion technology to renewables’, he was clearly trying to tread a line between Coalition hardliners and Teal voters opposed to high carbon emissions. He went on to say that “there is no better example of the risk of over-reliance on one market than what we saw with many European countries’ dependence on Russian gas”, and that the nuclear submarines Australia is committed to under AUKUS “are essentially floating SMRs”.

An important economic marketing point was that the inclusion of nuclear would facilitate the pathway to “an Australia where we can decarbonise and, at the same time, deliver cheaper, more reliable and lower emission electricity”. By comparison, a report by the Australian Conservation Foundation in October 2023 said the next generation of nuclear reactors being advocated by the Coalition would ‘raise electricity prices, slow the uptake of renewables and introduce new risks from nuclear waste’.

If you have an instinctive response to the nuclear option (either negative or positive) but need evidence to confirm or reject your assumptions and question your certainties, so do I. France’s dependence on nuclear power, Sweden’s continued use of nuclear energy despite an earlier referendum to close it down and Germany’s concerns for the complete closure of nuclear power in 2023 are lessons to be considered.

So that’s where ‘The Drill’ comes in …..

Can the answers be found in a few hours of online enquiry, using the scientific method and unbiased evidence – although unbiased evidence is clearly an oxymoron.

In this edition of ‘The Drill’, I plan to frame the question, provide methods for the search, succinct results without commentary and a short more discursive discussion. Then you make your own conclusions, including responding if you can identify where I may have gone wrong!

Aims: There are many nuclear questions but I’m restricting this to: are nuclear small modular reactors (SMRs) being used successfully elsewhere, and if so, do they have a future in Australia’s energy transition and mix?

Methods: I searched for information relating to this question in publicly accessible reports from 2022-2024. This proved to be more challenging than expected, because in most cases, reports were published by stakeholders with conflicts of interest. The most balanced report was luckily the most comprehensive from the CSIRO. The web URLs for my sources are provided below.

Results:

First, we do need some definitions.

Nuclear SMRs are newer generation reactors defined by their power output. They are designed to generate electric power at typically less than 300 Mwelectric (MWe) and may also be used for non-electrical industrial applications such as water desalination and heat generation for industry. According to the International Atomic Energy Agency (IAEA) Booklet on Advances in SMR Technology Developments published in 2022, there are more than 80 SMR concepts currently under development, ranging from single-unit installations to multimodule plants. Manufacturing, assembly and testing may occur in factory, and siting may be on ground, underground, floating, underwater or movable. Therefore, nuclear SMRs may be applicable to regions lacking electrical grid and cooling water infrastructure.

Where are nuclear SMRs currently operating?

China has one prototype nuclear SMR, the Linglong-1, which is a multi-purpose 125 Mwe pressurised water reactor. Construction started on 13 July 2021 and according to Chinese Global Times (6 September 2023) it is expected to be completed and put into operation in 2026. China sees potential for deploying nuclear SMR technology and Chinese professionals to oversee it to partner countries, particularly developing countries and those participating in the Belt and Road initiative. A spokesperson for the Nuclear Power Institute of China said that The Linglong-1 is a highly suitable nuclear energy technology for cities that have a relatively small grid, and for islands where large nuclear plants cannot fit.

A 2023 report Ordered by the British House of Commons (13 July 2023) highlighted the investment by China in the UK energy market and in particular in the nuclear energy sector, and seeks to further its influence by exporting nuclear technology.

Russia has four land-based operating EGP-6 SMRs, which form the Bilibino Nuclear Power Plant, commissioned in 1974-1977. The reactors supply Bilibino with a population of around 5000 people (many of whom are employed by the plant), with electricity, heated water, and steam. The EGP-6 (the acronym standing for Power Heterogenous Loop reactor) are SMRs that are scaled down versions of the larger RBMK design. Both use water for cooling and graphite as a neutron moderator, and the EGP-6 reactors are the only reactors to be built on perma-frost. As of 2020, the power plant was ready for decommissioning, to be replaced by the Akademik Lomonosov floating nuclear power plant, The first EGP-6 reactor was shut down in December 2018, and the other three EGP-6 reactors were scheduled to follow in December 2021, however a decision was made in 2020 to renew the license of one of the three reactors until December 2025.

Russia has a number of nuclear SMRs in design and development stages including the BREST reactor, a lead-cooled fast reactor, the main characteristics of which are passive safety and a closed fuel cycle. Lead is chosen as a coolant for being high-boiling, radiation-resistant, low-activated and at atmospheric pressure. Russia on Wikipedia here and here

In the USA the only commercial SMR project to receive design certification from the Nuclear Regulatory Commission (an essential step before construction can commence), was cancelled in November 2023. The Utah Associated Municipal Power Systems project (UAMPS) was the developer of a nuclear SMR project called the Carbon Free Power Project, with a gross capacity of 462MW and planned to be fully operational by 2030. In late 2022 UAMPS updated their capital cost to $31,100/kW citing the global inflationary pressures that have increased the cost of all electricity generation. The CSIRO Gencost report states that ‘This estimate implies that nuclear SMRs have been hit by a 70% cost increase, which is much larger than the average 20% observed in other technologies. The significant increase in costs likely explains the cancellation of the project.’ This was the only proposed SMR in the USA with regulatory approval.

What is the cost of electricity production using nuclear SMRs?

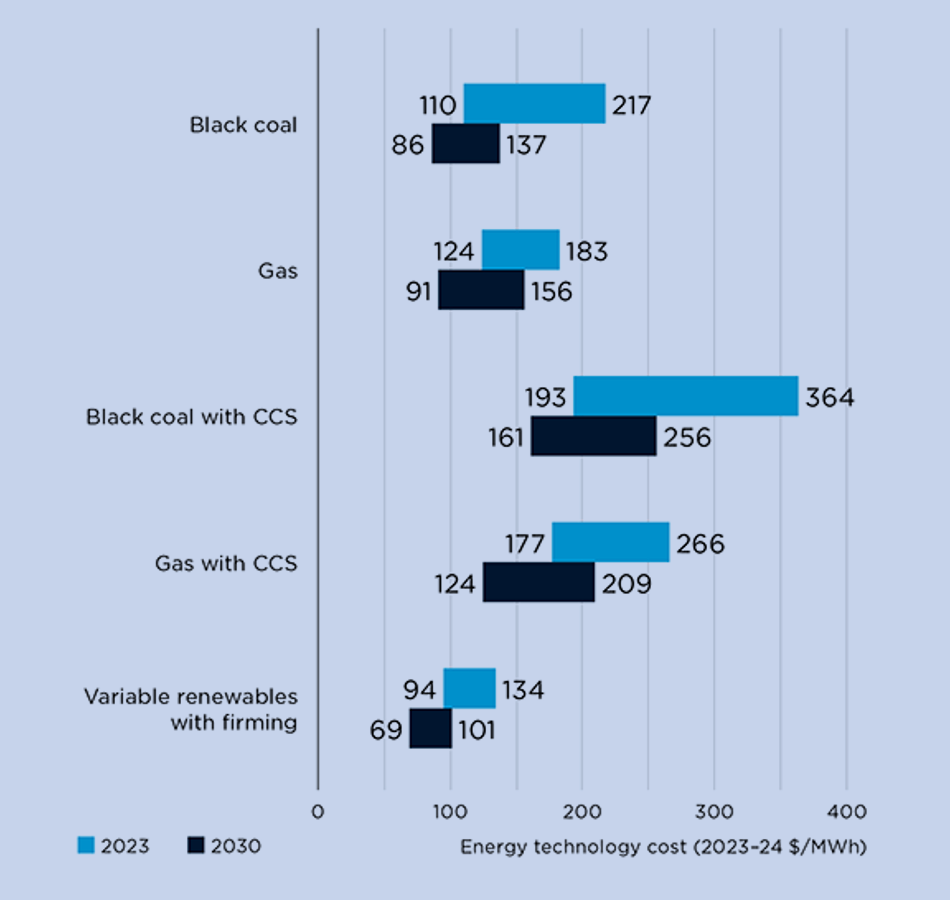

Each year the CSIRO and the Australian Energy Market Operator (AEMO) work with industry and key stakeholders to produce cost estimates for new-build electricity generation in Australia (Gencost). This is Australia’s most comprehensive electricity generation cost projection report. The 2023-2024 draft Gencost report was recently released. It utilises the ‘levelised cost of electricity’ (LCOE) cost comparison metric, being ‘the total unit cost a generator must recover to meet all its costs, including a return on investment’. High and low-cost estimates are used to produce an LCOE range for each technology

Gencost stated that ‘The LCOE cost range for variable renewables [wind and solar power] with integration costs is the lowest of all new-build technologies in 2023 and is predicted to be lowest in 2030. The cost range overlaps slightly with the lower end of the cost range for coal and gas generation, but those costs are only achievable if they can deliver a high capacity, source low-cost fuel and be financed at a rate that does not include climate policy risk, despite their high emissions, which is a non-viable option. If we exclude high emission generation options (coal and gas), the next most competitive generation technology is gas with carbon capture and storage’ (see graph below).

For nuclear SMRs, Gencost stated that conflicting data has been published. Projects completed or in construction in Russia and China are 100% government funded and as indicated above, the Utah Associated Municipal Power Systems project was cancelled in November 2023 due to cost over runs.

Costs for all technologies increased in 2022-2023. The cost increase for large scale solar was the lowest at 9%, and this increase was expected to be reversed in 2023-2024, with a cost decline of 8% predicted. Onshore wind saw significant increases in costs in 2022 – 2023 of 35%, with a further increase of 8% expected in 2023-2024. According to the CSIRO, cost pressures were likely to remain for new-build gas, onshore wind and nuclear SMRs.

Levelised cost of electricity (LCOE): Variable renewables have the lowest cost range of any new-build technology, both now and in 2030. CCS: Carbon capture and storage

What about nuclear waste and nuclear SMRs?

The management of Spent Nuclear Fuel (SNF), appears to have had limited consideration. For countries embarking or willing to embark on an SMR programme, whether they are nuclear countries or newcomers, understanding the implications of the spent fuel management programme that would need to be undertaken is important to make informed decisions on the specificities of different SMR technologies and on the fuel cycle options.

In a recent article in the Proceedings of the National Academy of Sciences May 31, 2022, the authors stated that remarkably few studies have analysed the management and disposal of nuclear waste streams from SMRs, yet results reveal that water, molten salt and sodium-cooled SMR designs will increase the volume of nuclear waste in need of management and disposal by factors of 2 to 30-fold, attributed to the use of neutron reflectors and/or of chemically reactive fuels and coolants. In addition, SMR spent fuel will contain relatively high concentrations of fissile nuclides, which will demand novel approaches for storage and disposal. Since waste stream properties are influenced by neutron leakage, a basic physical process that is enhanced in small reactor cores, SMRs will exacerbate the challenges of nuclear waste management and disposal. The authors conclude that SMRs will exacerbate the volume and complexity of low and intermediate level waste and spent nuclear fuel and will offer no apparent benefit in the development of a safety case for geological repositories.

What other countries are doing:

A number of governments feel that nuclear SMR technology may be applicable to their energy mix. On the 8th December 2023, according to a World Nuclear News report (which draws comment from intergovernmental agencies, uranium miners, nuclear equipment manufacturers and the nuclear power generation industry).

Poland’s Ministry of Climate and Environment issued a ‘decision-in-principle’ for the construction of 24 BWRX-300 SMRs at six locations.

In the USA, the current Palisades large nuclear plant in Michigan was shut down in May 2022, after 50 years in service, with decommissioning envisaged for completion in 2041. However, after its sale, the new owner (Holtec) filed for authorisation to refurbish the large reactor for power operations to recommence in 2025, and to add two nuclear SMR-300 units to the site by 2030. Holtec stated that this would eliminate delays associated with erecting the SMRs at an undeveloped property. However, at present the Palisades reactor is classed by the US Nuclear Regulatory Commission as being in “full decommissioning”.

On March 2011, one quarter of Germany’s electricity was generated using nuclear power from 17 reactors. However, a number of subsequent governments responded to public pressure by progressively closing those plants, and the decommissioning of the Emsland, Isar II, and Neckarwestheim II reactors by April 16th 2023 saw the cessation of all nuclear energy production in Germany.

Meanwhile, Sweden, with a population less than half that of Australia at 10.64 million, had also called for closure of its nuclear reactors in 1980, and has only six of its original 12 reactors still in operation. Russia’s invasion of Ukraine in February 2022 caused a sharp increase in energy prices in Europe, and Swedish concerns about energy security caused further shutdowns to be cancelled. In fact, on the 16th November 2023, the government announced that it may expand its current nuclear energy production to help meet projected power demands and net-zero carbon emissions from the power sector by 2045.

The government said it aimed to build the equivalent of two new conventional nuclear reactors by 2035 to meet demand from industry and transport, and was prepared to take on some of the costs. By 2045 the government wants to have the equivalent of 10 new reactors, some of which are likely to be SMRs. Of note, the current Swedish prime minister, Ulf Kristersson, runs a minority government that relies on confidence and supply from the nationalist right wing Swedish Democrats, who have called for an expansion of nuclear energy.

Discussion

Where does this leave Australia?

At present, renewable power production with battery storage appears to be a viable and cost-effective option. Some amount of gas power is expected to be required to provide firming, and emissions from gas could be abated using carbon capture and storage, although example projects have captured only a limited percentage of the emissions generated. When completed, pumped hydro from Snowy 2.0 will also provide rapid, on-demand power, when generation from renewables fluctuates. This combination of options is the cheapest predicted source of power production through to 2030. After that, nuclear SMRs may be available as viable, competitive power options, but at present that is not the case. In addition, with no current nuclear power generation but with huge opportunities in the production of clean renewable energy by solar and wind, together with the export of clean metals and low-carbon industrial goods, the need for SMRs is unnecessary and a potential distraction from accessible, cheaper technologies.

Based on current experience in China, Russia and the USA, if Australia invested in SMR technology there would be significant risks in relation to costs and potential delays.

We certainly do need to carefully consider the vulnerability of our power production and the vicissitudes of international trade partners, particularly China following recent trade restrictions. However, risks to renewable supply chains can be mitigated by diversifying sources of solar and wind technology, and by investing in local renewable manufacture and research. It is worth remembering that solar production in China was largely based on research from the University of NSW, which had just invented a cell design that went on to become the global commercial standard. After working with the research team, a student from Shanghai took that research back to China and founded the nation’s first solar manufacturing company, Suntech. It listed on the New York Stock Exchange in 2005, heralding the start of a Chinese solar boom.

It is interesting to examine Germany’s energy mix during the progressive shutdown of nuclear. Germany has boosted clean energy by 44% since 2015 and has reduced fossil fuel power by 11%. Solar provided 29% and wind 29% of the energy mix in 2022, at which point nuclear provided 4%, coal 18% and gas 11%. Despite high electricity costs, many Germans feel that the shutdown of nuclear will benefit the energy transition. Solar and wind generation fluctuate but nuclear provides continuous power, so batteries, pumped hydro or gas are more readily integrated with wind and solar generation than nuclear.

Finally, there is the not insurmountable but nevertheless difficult issue of the siting of nuclear facilities and nuclear waste disposal. For some years Australia has been developing the innovate nuclear waste technology ‘Synroc’, which provides a matrix for nuclear waste disposal, but waste from SMRs will be greater and potentially more difficult to dispose of than waste from larger nuclear facilities. Waste disposal and siting of nuclear facilities will continue to pose problems within urban, rural and remote communities and for indigenous peoples.

In summary, based on the evidence I have accessed, Australia should NOT look to nuclear SMRs at this point, or in the intermediate future. If we are actually technology neutral, and if we want greater surety of supply, then nuclear SMRs are not currently our way ahead. A political focus on SMRs in our energy mix could also delay the transition to viable, attainable, cost-effective clean energy alternatives to fossil fuels.

By Grahame Elder

References:

- CSIRO draft 2023-2024 Gencost report

- International Atomic Energy Agency reports

- Wikipedia

- In a House of Commons Security Committee China report (printed 13 July 2023)

- The Global Times

- World Nuclear News

- https://world-nuclear-news.org/Articles/Linglong-One-reactor-pit-installed-at-Changjiang

- https://world-nuclear-news.org/Articles/Six-SMR-power-plants-approved-in-Poland

- https://world-nuclear-news.org/Articles/Palisades-SMR-programme-is-under-way-Holtec

- Power Digest

- World Nuclear Organisation

- CNBC and the Guardian here and here

- Proceedings of the National Academy of Sciences May 31, 2022 119 (23) e2111833119

- Royal United Services Institute for Defence and Security Studies

- Reuters